The same process applies to recording accounts payable and business expenses. More specifically, deferred revenue is revenue that a customer pays the business, for services that haven’t been received yet, such as yearly memberships and subscriptions. If you haven’t decided whether to use cash or accrual basis as the timing of documentation for your small business accounting, our guide on the basis of accounting can help you decide. There’s an accounting principle you have to comply with known as the matching principle. The matching principle says that revenue is recognized when earned and expenses when they occur (not when they’re paid). Accruals refer to payments or expenses on credit that are still owed, while deferrals refer to prepayments where the products have not yet been delivered.

( . Adjusting entries for accruing uncollected revenue:

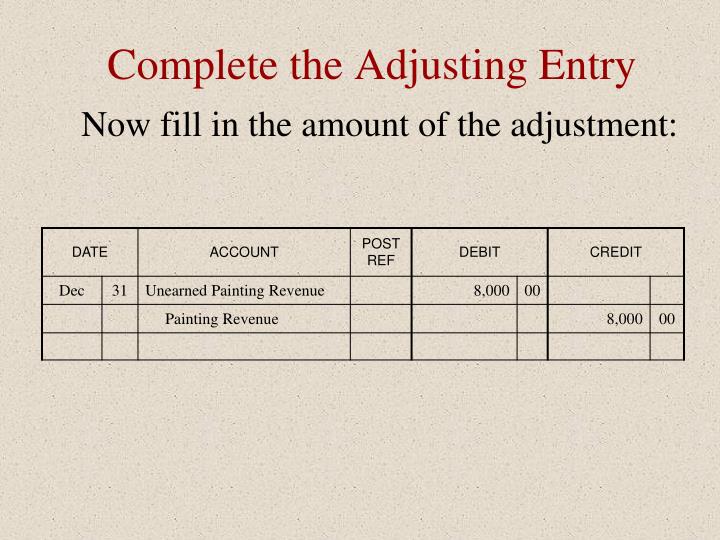

If you granted the discount, you could post an adjusting journal entry to reduce accounts receivable and revenue by $250 (5% of $5,000). Adjusting entries are changes to journal entries you’ve already recorded. Specifically, they make sure that the numbers you have recorded match up to the correct accounting periods. Unearned revenues are also recorded because these consist of income received from customers, but no goods or services have been provided to them. In this sense, the company owes the customers a good or service and must record the liability in the current period until the goods or services are provided. Now that we know the different types of adjusting entries, let’s check out how they are recorded into the accounting books.

Steps for Recording Adjusting Entries

To record deferred revenue, an adjusting entry is made to decrease the liability account and increase the corresponding revenue account. To record accrued revenue, an adjusting entry is made to increase the revenue account and increase the corresponding asset account. This category of adjusting entries is also known as unearned income, deferred revenue, or deferred income. Essentially, it refers to money you’ve been prepaid by a client before you’ve done the work or provided services.

Accrued expenses

When something changes, whether that be an asset depreciating, income received months after a transaction, or late payment to a client, your balance sheet will need an set up your xero bank feeds to show the change. Adjusting journal entries are accounting journal entries that update the accounts at the end of an accounting period. Each entry impacts at least one income statement account (a revenue or expense account) and one balance sheet account (an asset-liability account) but never impacts cash. The entry records any unrecognized income or expenses for the accounting period, such as when a transaction starts in one accounting period and ends in a later period. The balance sheet is also affected by adjusting entries, as these adjustments ensure that assets, liabilities, and equity are accurately reported.

Why are Adjusting Entries Necessary?

- These entries are made at the end of an accounting period to adjust accounts and reflect any changes that have occurred during the period.

- The four types of adjustments in accounting include accruals, deferrals, reclassifications, and estimates.

- Posting adjusting entries is no different than posting the regular daily journal entries.

- The main objective of maintaining the accounts of a business is to ascertain the net results after a certain period, usually at the end of a trading period.

This can happen when estimates are not updated or when they are based on incorrect assumptions. To avoid this mistake, it is important to review and update estimates regularly. One of the most common mistakes is making incorrect accounting entries. This can happen due to a lack of attention to detail or a misunderstanding of accounting principles. To avoid this mistake, it is essential to double-check all entries and ensure that they are accurate. Aside from keeping everything neat and organized, adjusting entries is actually vital to your business if you want to keep an accurate record of your finances.

Prepaid expense

Press Post and watch your fixed assets automatically depreciate and adjust on their own.

When office supplies are bought and used, an adjusting entry is made to debit office supply expenses and credit prepaid office supplies. These entries are posted into the general ledger in the same way as any other accounting journal entry. The purpose of adjusting entries is to show when money changed hands and to convert real-time entries to entries that reflect your accrual accounting.

Accruals are adjustments made for revenues that have been earned but not yet recorded, and expenses that have been incurred but not yet paid. For instance, a company may have provided services in December but will not receive payment until January. An accrual entry ensures that the revenue is recorded in December, aligning with the period in which the service was provided. Similarly, if a business incurs an expense in one period but pays for it in the next, an accrual entry is necessary to reflect the expense in the correct period. This method adheres to the matching principle, which states that expenses should be recorded in the same period as the revenues they help generate. An adjusting entry is an entry made to assign the right amount of revenue and expenses to each accounting period.

If you do your own bookkeeping using spreadsheets, it’s up to you to handle all the adjusting entries for your books. Then, you’ll need to refer to those adjusting entries while generating your financial statements—or else keep extensive notes, so your accountant knows what’s going on when they generate statements for you. The other deferral in accounting is the deferred revenue, which is an adjusting entry that converts liabilities to revenue. Accrued expenses are expenses made but that the business hasn’t paid for yet, such as salaries or interest expense. For example, let’s assume that in December you bill a client for $1000 worth of service.

For example, a company that has a fiscal year ending Dec. 31 takes out a loan from the bank on Dec. 1. The terms of the loan indicate that interest payments are to be made every three months. In this case, the company’s first interest payment is to be made on March 1. However, the company still needs to accrue interest expenses for the months of December, January, and February. Estimating too high or too low can also lead to incorrect financial statements.

By December 31, one month of the insurance coverage and cost have been used up or expired. Hence the income statement for December should report just one month of insurance cost of $400 ($2,400 divided by 6 months) in the account Insurance Expense. The balance sheet dated December 31 should report the cost of five months of the insurance coverage that has not yet been used up. Balance sheet accounts are assets, liabilities, and stockholders’ equity accounts, since they appear on a balance sheet. This is true because paying or receiving cash triggers a journal entry.