All participants must be at least 18 years of age, proficient in English, and committed to learning and engaging with fellow participants throughout the program. HBS Online does not use race, gender, ethnicity, or any protected class as criteria for enrollment for any HBS Online program. Our easy online enrollment form is free, and no special documentation is required.

Key Takeaways

SoFi does not guarantee or endorse the products, information or recommendations provided in any third party website. This offers a different perspective on the driving forces behind a company’s income trends, revealing a bit more detail about the costs for making the product or providing the service. Avoiding common accounting errors is the best way to ensure the accuracy of your income statement.

- In some cases, revenue may be divided into two types — operating revenue (the revenue gained by a company’s primary activities) and nonoperating revenue (the revenue gained from non-core business activities).

- It lists income, which is all the money earned, and expenses, which are all the money spent.

- We handle the hard part of finding the right tax professional by matching you with a Pro who has the right experience to meet your unique needs and will manage your bookkeeping and file taxes for you.

- By regularly analyzing your income statements, you can gather key financial insights about your company, such as areas for improvement or projections for future performance.

- Preparing financial statements can seem intimidating, but it doesn’t have to be an overwhelming process.

Traditional vs. Variable Income Statements

It reveals a company’s profitability trends by comparing the current profitability to past profitability figures. You can see quickly whether a company has made a profit or a loss during a particular accounting period, usually quarterly or annually. A traditional income statement, also known as a profit and loss (P&L) statement, provides a snapshot of a company’s ability to make money. It includes several key metrics that help you better understand how the firm’s profit and loss relate to each other. The first step in preparing an income statement is to choose the reporting period your report will cover.

Would you prefer to work with a financial professional remotely or in-person?

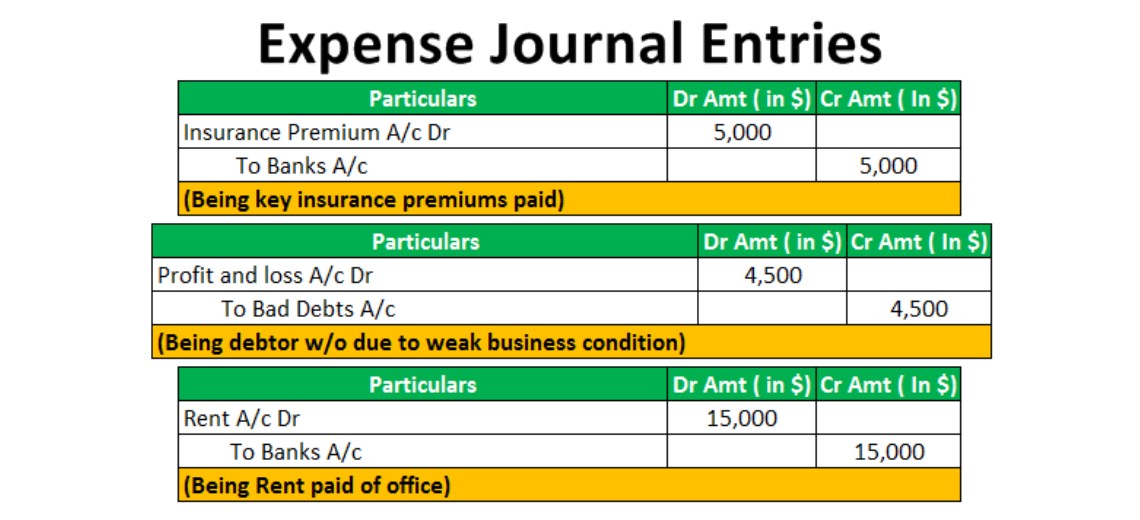

First, the gross profit is computed by deducting cost of sales from sales. Operating expenses include selling expenses and administrative expenses. Add up all the operating expenses listed on your trial balance report.

Operating expenses encompass the day-to-day costs of running the business such as salaries, rent, utilities, and marketing expenses. Non-operating revenue and expenses consist of income and costs not directly related to the core operations. EBIT and EBITDA are crucial metrics used to assess a company’s operational efficiency and cash flow generation. Understanding these components aids in evaluating the financial health and performance of a business.

Businesses typically choose to report their P&L on an annual, quarterly, or monthly basis. Publicly traded companies are required to prepare financial statements on a quarterly and yearly basis, but small businesses aren’t as heavily regulated in their reporting. For this article, we’ll focus on traditional income statements which lets us look at the big picture. As a business owner, this income statement gives you an idea of the company’s overall positive or negative business profit.

If everybody had to file independent contractor taxes, we’d see a revolution in our nation’s tax code. Most people work for an employer at W-2 jobs where their taxes are automatically take out each pay period. Other helpful tips include some things that people don’t often think about related to how you present your reports. Income Statements that are accurate but hard to read aren’t very helpful. Finding an accountant to manage your bookkeeping and file taxes is a big decision. The income ranges for determining eligibility to make deductible contributions to traditional Individual Retirement Arrangements (IRAs), to contribute to Roth IRAs and to claim the Saver’s Credit all increased for 2025.

These are expenses incurred while operating the business and not directly related to production. They are reported separately from COGS in the income statement and include expenses for salespeople and office staff, marketing and advertising, rent for office space, and utilities. Depending on a company’s transparency, these may be listed individually under the heading SG&A. Investors use core financial reports like traditional income statements to analyze a potential investment. They review profitability trends that can provide clues for how well the company may perform in the long-run. Information on income statements can be compared to the company’s past income statements, as well as to its competitors.

Next, subtract all the other costs of running the business, like paying for the office (fixed expenses) and advertising (marketing). After taking away these costs from the gross profit, you’ll see your operating income. A irs guidance clarifies business separates costs by production costs and overhead costs, includes both fixed and variable expenses, and calculates gross profit. It shows the company’s revenues and expenses during a particular period, which can be selected according to the company’s needs. A P&L, which stands for profit and loss, indicates how the revenues are transformed into net profit.

Next, we subtract selling and administrative expenses, which are costs not directly tied to making products but necessary for running the business. After taking away these expenses from the gross margin, we get the operating income. This number shows us how much money the business really made after covering all its costs. It’s a key part of checking a company’s financial health and figuring out if it’s making enough money to keep going.