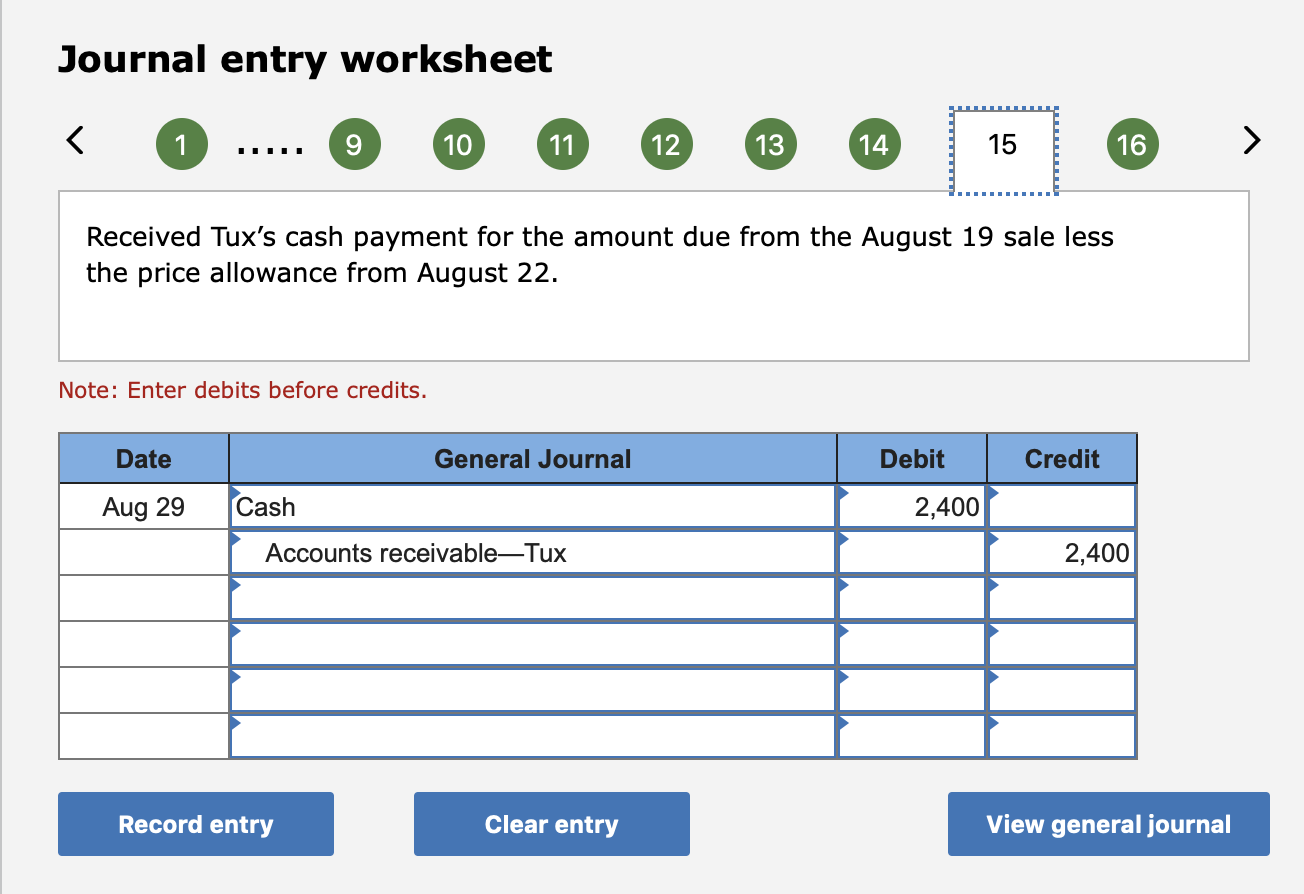

Verify that the correct date and amount are entered for each transaction. In case of any discrepancies, double-check the payment and deposit entries to ensure accuracy. Matching deposits to invoices and payments is a critical aspect of clearing undeposited funds in QuickBooks Online, ensuring accurate reconciliation and financial tracking. The process of clearing undeposited funds in QuickBooks Online involves several important steps to ensure accurate recording and reconciliation of payments. This account is special because it’s a temporary account that QuickBooks uses to hold received payments from invoices before you deposit them in the bank.

Payments processed with QuickBooks Payments:

This process also applies if you collect checks and cash from your customers and then like to make one deposit into the bank. With your deposit slip in hand, you can record a bank deposit and combine the payments in QuickBooks. All payments in the Undeposited Funds account automatically appear in the Bank Deposit window. Since both transactions were dated on Jan. 29, the first thing to check for is a deposit in your Bank Register for $2,062.52 dated on or around Jan. 29.

QuickBooks Alternative For Small Business Owners and Freelancers

Recording undeposited funds appropriately is crucial for maintaining transparency and accuracy in financial reporting. By managing undeposited funds effectively, businesses can gain a clear picture of their cash flow, reduce errors, and maintain a precise record of their financial activities in QuickBooks Online. When you put money in the bank, you often deposit several payments at once.

- As you can see above, my reconcile screen shows one deposit for those three payments and makes it easy for me to match with my bank.

- Deleting undeposited funds in QuickBooks requires careful consideration and accurate adjustments to ensure that all financial records remain consistent and transparent.

- Not giving your client a clear picture of how much money they have paid and how much they owe is a surefire way to tick people off and get clients to leave you pretty quickly.

Learn how to use the Undeposited Funds account in QuickBooks Online. Many users have found this account tedious because it’s not very intuitive to untrained users. Let’s look at them in more detail to get a better hold on how to work with the Undeposited Funds Account in QuickBooks. See our overall favorites, or choose a specific type of software to find the best options for you.

Next Steps: Review your Undeposited Funds account

QuickBooks is highly scalable and adapting to the changing business needs. So when it comes to accounting software, QuickBooks can be named ubiquitous. If you process invoice payments through QuickBooks Payments for Desktop, QuickBooks takes care of everything for you. Why not set up QBO to make deposits directly into the bank account as a default? This sounds like a good idea in theory, and it even works when you are a small solopreneur.

In the end, it is the reconciliation process that really brings clarity of revenue received to your business. Chances are you will occasionally receive payments from multiple customers and batch those into one deposit. Posting these payments to the Undeposited Funds account will allow you to correctly record the deposit in QuickBooks Online, making reconciling your bank account easier.

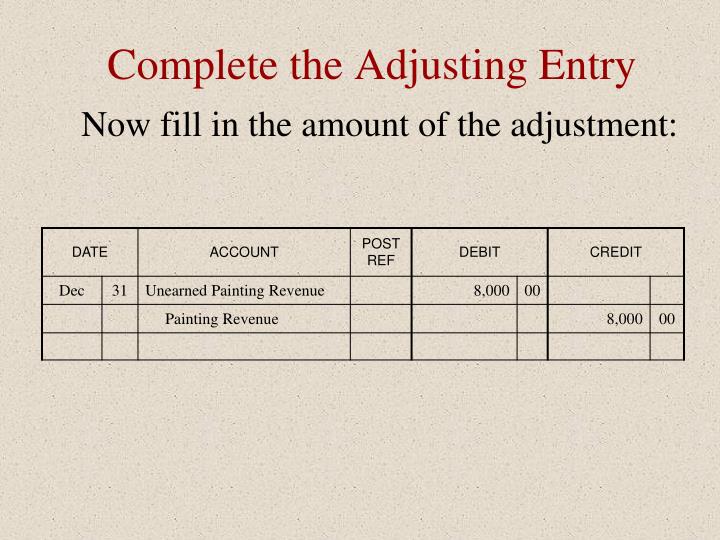

Also, be sure you are posting the deposit to the correct account — in this case, checking — and that the date on the transaction is the date you will take the deposit to the bank. For example, let’s say Willie’s Widgets paid you $300, Wally’s Whatsits paid you $750 and Whitley’s Whosits paid you $200. However, you need to properly credit each customer for their payment. Posting each payment to the Undeposited Funds account and then recording the deposit in QuickBooks Online allows you to do this. This step involves reviewing all transactions to confirm that the funds awaiting deposit match the actual amounts received.

Reconciling undeposited funds to payments and accounts receivables will result in the eternal present value of future minimum lease payments calculator mystery of the undeposited funds account being unraveled, and the riddle being solved. Another way to skip the tedious process is by accepting credit cards or another online payment option such as ACH. This post will help you understand the purpose of an undeposited funds account, how to clear it, and how to avoid having payments automatically posted to this account. The importance of this step becomes even more apparent in the next screenshot. As we know, reconciling is an integral part of your books and keeping them accurate.