You will learn how to utilize this ratio’s formula to examine a company’s current debt situation by looking at its equity. The return on equity ratio varies from industry to industry and depending on a company’s strategies. For example, a retailer might expect a lower return due to the nature of its business compared to an oil and gas firm. To arrive at the total shareholders’ equity balance for 2021, our first projection period, we add each of the line items to get to $642,500. Now that we’ve gone over the most frequent line items in the shareholders’ equity section on a balance sheet, we’ll create an example forecast model. If we rearrange the balance sheet equation, we’re left with the shareholders’ equity formula.

Equity Ratio vs Debt Ratio

Moreover, a return on equity ratio is considered good if the return to equity ratio is 15% to 20%. In other words, if ABC Widgets liquidated all of its assets to pay off its debt, the shareholders would retain 75% of the company’s financial resources. Since we’re working to first calculate the total tangible assets metric, we’ll subtract the $10 million in intangibles from the $60 million in total assets, which comes out to $50 million. While sustainability is an integral part of CSR, it deserves special attention due to its long-term implications on a company’s brand image and bottom line. Companies with a strong equity ratio are in a position to make significant investments required to meet their sustainability goals.

What is the approximate value of your cash savings and other investments?

Investors use financial research software can be used to compare equity ratios across industries. Debt RepaymentCompanies looking to improve their equity ratio could prioritize repaying existing debts. This means properly planning the company’s finances to ensure regular, on-time loan repayments to gradually reduce the liabilities over time. A company with high equity ratio might be seen as a less risky investment, as they are less subject to interest rates fluctuations and have fewer obligations to lenders. This might be more attractive to conservative investors who prioritize stability over high returns.

During Periods of Financial Uncertainty

This is an easy number to calculate as long as you have your numbers handy from your balance sheet. There is a clear distinction between the book value of equity recorded on the balance sheet and the market value of equity according to the publicly traded stock market. From the viewpoint of shareholders, treasury stock is a discretionary decision made by management to indirectly compensate equity holders. The “Treasury Stock” line item refers to shares previously issued by the company that were later repurchased in the open market or directly from shareholders. Next, the “Retained Earnings” are the accumulated net profits (i.e. the “bottom line”) that the company holds onto as opposed to paying dividends to shareholders. When companies issue shares of equity, the value recorded on the books is the par value (i.e. the face value) of the total outstanding shares (i.e. that have not been repurchased).

- Active liabilities management plays an essential role in improving the equity ratio.

- Therefore, if a company’s equity ratio deteriorates due to bad performance or excessive borrowing, it risks breaching such covenants.

- Equity financing in general is much cheaper than debt financing because of the interest expenses related to debt financing.

- Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

Equity Ratio: Understanding its Implications in Financial Analysis

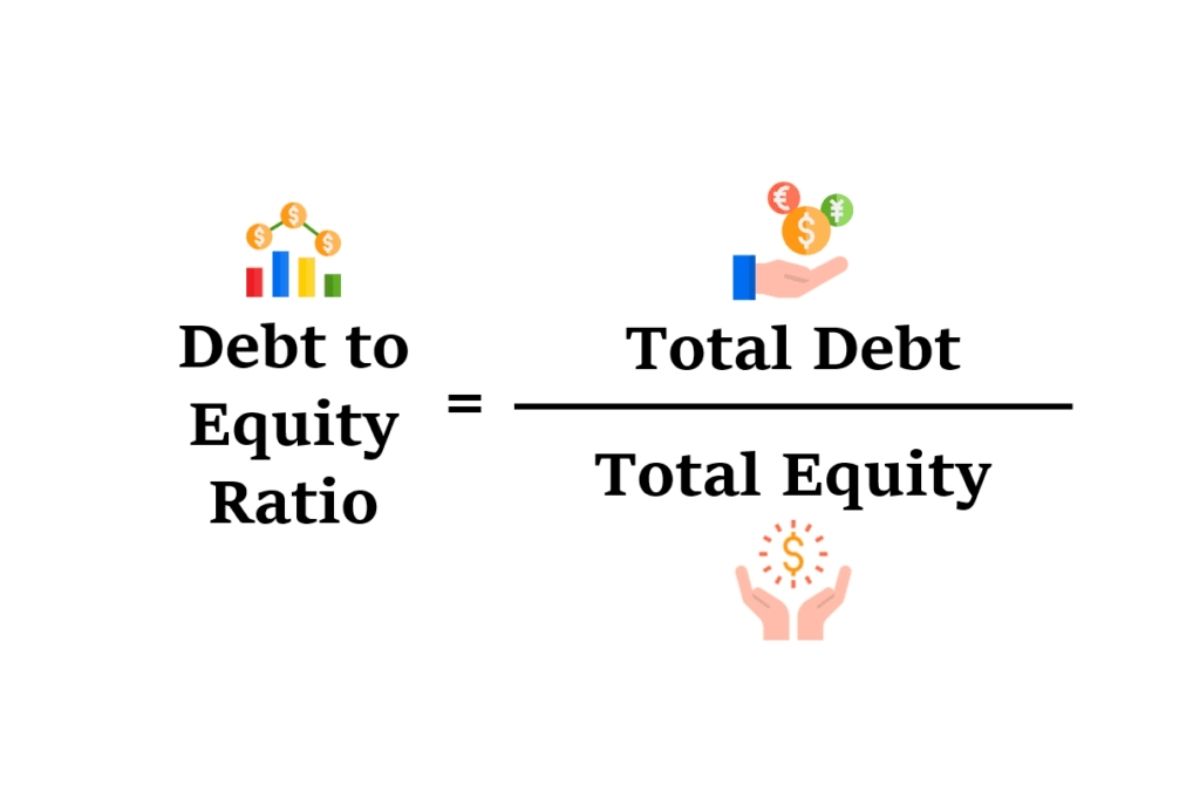

Conversely, investors who are open to higher risk levels for potentially higher returns may look out for opportunities to invest in companies with a lower equity ratio. These firms tend to rely more on borrowings which can increase operational risks, but can also generate higher returns if these funds are employed effectively. Conversely, a high debt ratio might be indicative of a riskier investment proposition. Total assets equal the sum of non-current and current assets, and it is equal to the sum of shareholder’s equity and total liabilities.

The main limitation is the difference in equity ratios across various industries. The industries’ specific characteristics and financial environments can significantly influence an equity ratio. For instance, capital intensive industries such as utilities and manufacturing naturally have lower equity ratios due to their need to maintain a high level of debt for equipment, infrastructure, and working capital. On the other hand, service-based or software companies would typically have a higher equity ratio due to a lower requirement of physical assets and thus, carry less debt.

At the end of 2021, the company reported the following carrying values on its balance sheet. CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is xero hq on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path.

A high ratio may suggest higher financial risk, while a low ratio indicates less risk. A company with a favourable equity ratio, indicating a strong capital base, is often in a robust position to fund their CSR initiatives. Such companies can afford to undertake programs that may not bring immediate financial returns but can contribute significantly to societal benefits.

For mature companies consistently profitable, the retained earnings line item can contribute the highest percentage of shareholders’ equity. In these types of scenarios, the management team’s decision to add more to its cash reserves causes its cash balance to accumulate. Stockholders’ equity (SHE) and total assets are both found in a company’s balance sheet. Some industries have higher standards than others, based on volatility and industry trends. Between two companies in different industries, you couldn’t determine which one has a better equity ratio without first comparing each one to its own industry’s benchmarks.